Everything is going digital, and semiconductors are essential. They power our smartphones, AI, and military tech. There’s a global race for control over this industry, known as the “Silicon Cold War.” Tension between the U.S. and China is increasing, and Europe is jumping in with a massive $43 billion investment in semiconductors. This race for chip dominance changes how countries interact, economies, and even security strategies

The US-China Semiconductor Standoff

America’s Bid to Regain Chip Leadership

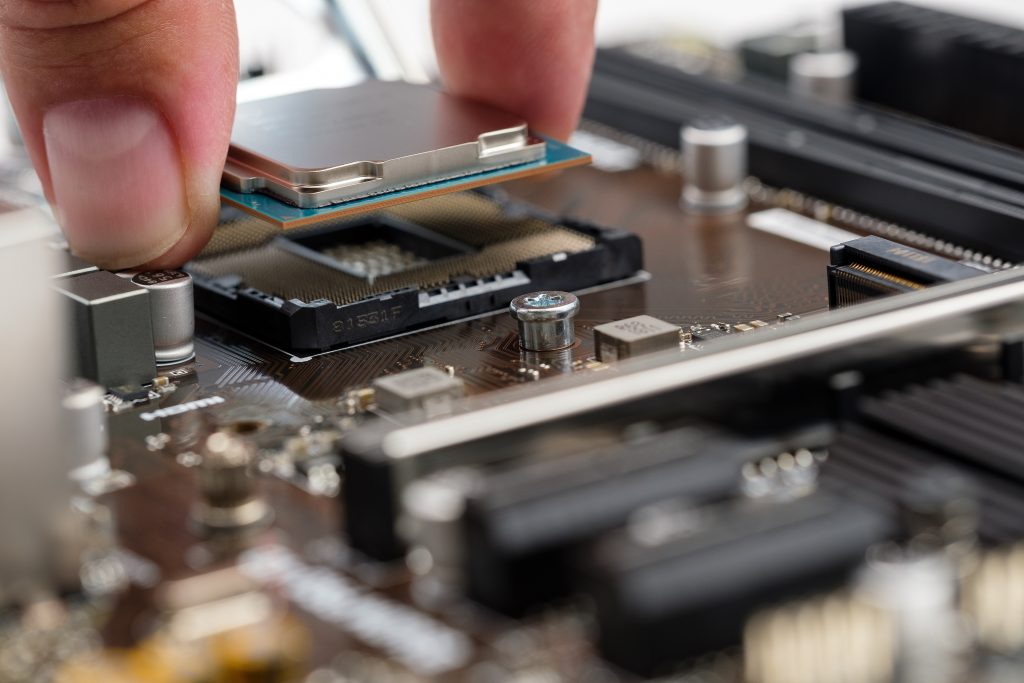

To counter China’s rise and address supply chain vulnerabilities exposed during the pandemic, the United States passed the CHIPS and Science Act in 2022, allocating $52 billion to revive domestic chip production. Companies like Intel are expanding factories in Arizona and Ohio, while research hubs like MIT collaborate on next-gen chips. There are still some challenges, like not having enough skilled workers and depending on Asian foundries for the latest tech, like TSMC’s 3nm chips, making it hard to be self-sufficient.

China’s Push for Self-Sufficiency

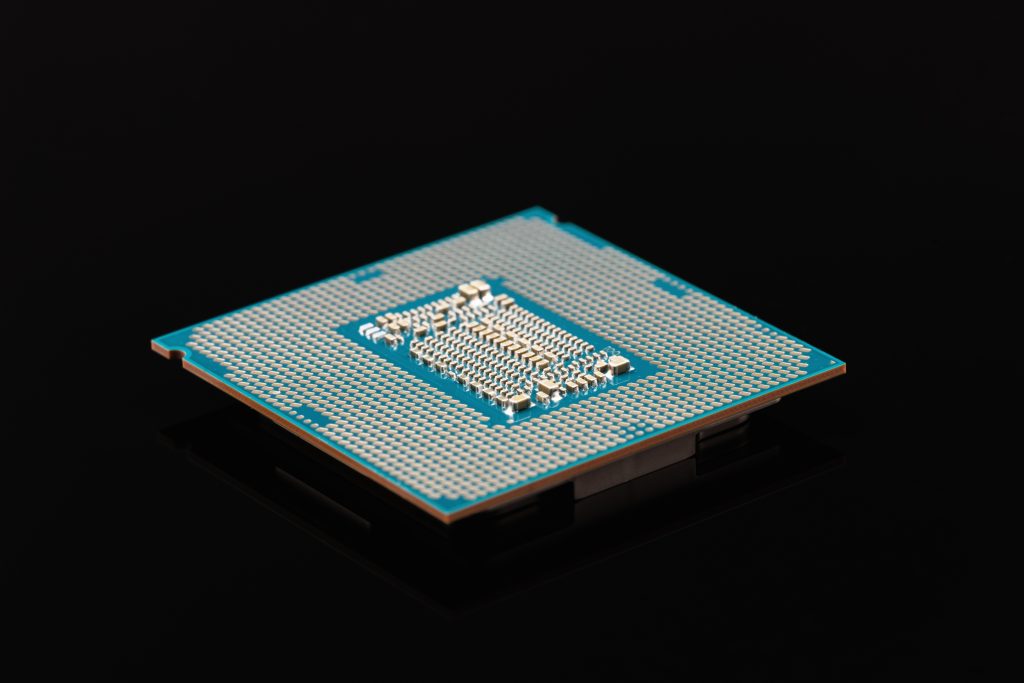

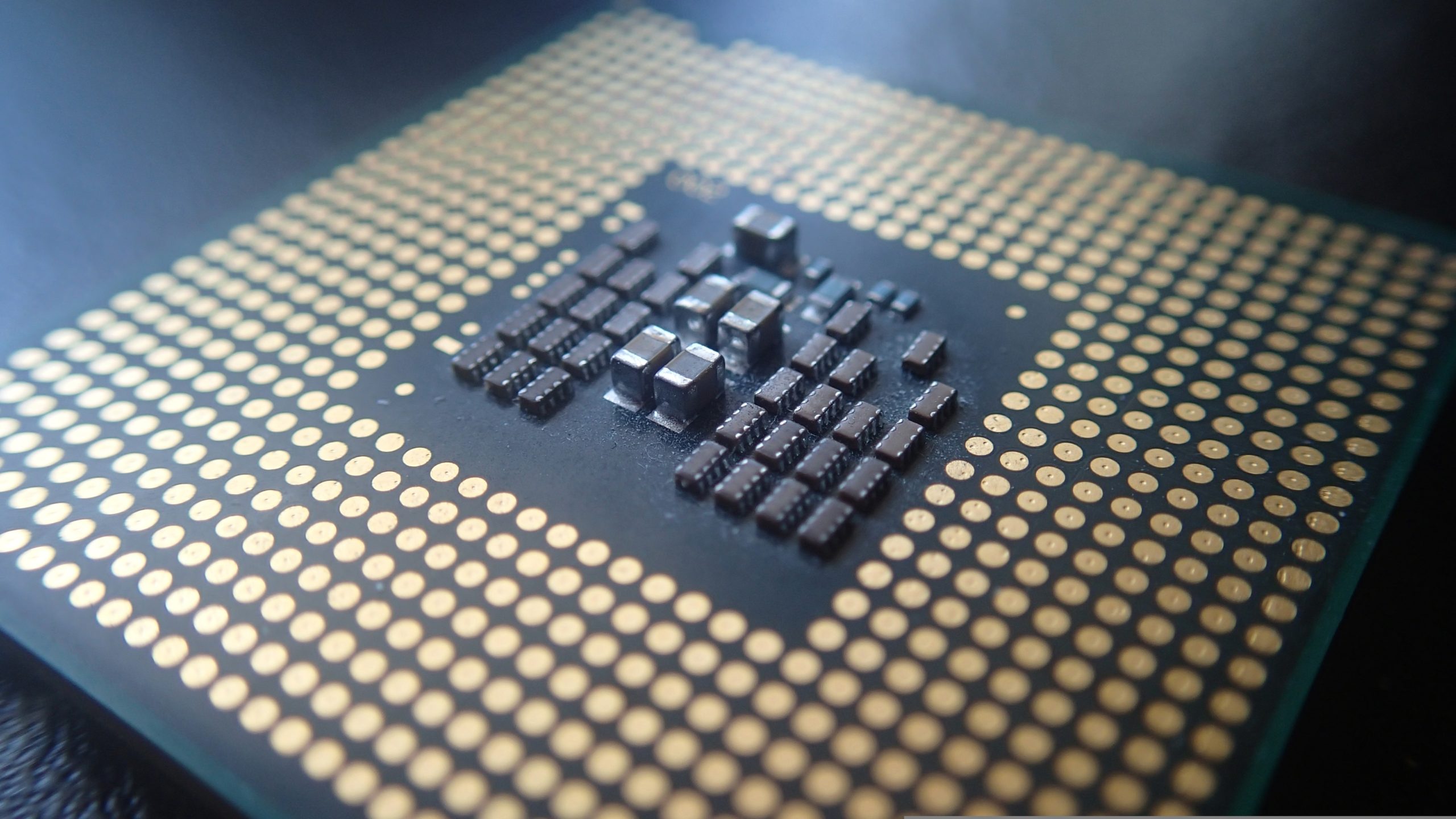

Despite being the world’s largest chip consumer, China remains dependent on foreign technology due to U.S. export restrictions. In response, Beijing has poured billions into its Semiconductor Manufacturing International Corporation (SMIC) and launched the “Made in China 2025” initiative to achieve 70% self-reliance by 2025. While SMIC has made strides in mature nodes (14nm chips), U.S. sanctions on advanced EUV lithography machines stifle progress.

Europe’s $43 Billion Gamble on Semiconductor Sovereignty

The European Chips Act Explained

Europe, responsible for just 10% of global chip production, aims to double its market share by 2030 through the European Chips Act this 33 billion investment in Germany. The EU also prioritizes “first-of-its-kind” facilities, such as Belgium’s IMEC, a leader in semiconductor research. By focusing on legacy chips (used in cars and IoT devices), Europe seeks to mitigate shortages while avoiding direct competition with U.S. and Asian giants in advanced nodes.

Challenges in Europe’s Semiconductor Ambitions

Europe has some big plans, but there are a few bumps. High energy prices, red tape, and a tight job market are slowing things down. ASML, a leading Dutch company in advanced tech, is worried that relying too much on U.S. export rules could mess up global supply chains. Plus, trying to innovate while keeping sustainability in mind a key European value makes it even trickier to grow quickly.

Taiwan’s Pivotal Role in the Semiconductor Ecosystem

TSMC’s Dominance and Geopolitical Risks

TSMC, a major chip maker in Taiwan, produces more than 90% of the world’s top-notch chips, which makes Taiwan important in the tech world. But with China’s claims over Taiwan and its growing military activities, people are worried about the possibility of a blockade or invasion. The U.S. has responded by urging TSMC to build fabs in Arizona, but replicating its ecosystem from specialized suppliers to engineers remains daunting.

Global Dependence on Taiwanese Semiconductors

A conflict over Taiwan could paralyze industries worldwide. Automotive giants like Ford and Toyota rely on TSMC for automotive chips, while Apple’s iPhones hinge on its cutting-edge processors. This dependency has prompted Japan and South Korea to bolster domestic production, but TSMC’s technological edge is unmatched.

Implications of the Semiconductor Cold War

Economic and Technological Consequences

The semiconductor race is changing global trade. U.S. rules on AI chip sales to China create separate supply chains, while countries like India and Vietnam try attracting chip investments. For consumers, this could mean higher prices and slower tech innovation.

The Future of Global Tech Collaboration

Initiatives like the U.S.-EU Trade and Technology Council aim to align standards and prevent full-scale decoupling. Open-source chip designs like RISC-V are fantastic for encouraging innovation, but geopolitical tensions still threaten to affect these efforts.

Navigating the Semiconductor Power Struggle

As nations invest billions and erect trade barriers, businesses must diversify supply chains, advocate for balanced policies, and prepare for a multipolar tech landscape. The stakes are high: whoever masters the silicon frontier will shape the future of AI, defense, and global power.

Leave a Reply